First it was politics, now it is the economy. The worst economic performance since 1Q 2013 is another wake-up call for the eurozone’s largest economy to take action.

The swan songs and obituaries on the golden decade of the German economy were already waiting in the wings (and devastating headlines had already been prepared). Monthly data over the last few months was simply too bad not to expect a disappointing 3Q performance of the German economy. The just-released first estimate of 3Q GDP confirms the negative gut feeling.

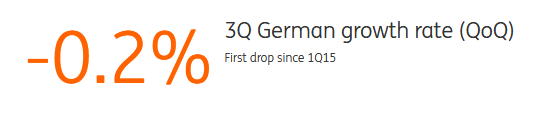

According to the first release of the statistical agency, the German economy had its worst performance in 3Q since the first quarter of 2013, shrinking by 0.2 % quarter-on-quarter. The first quarterly drop since the 1Q 2015. On the year, the economy still grew by 1.1%. The GDP components will only be released at the end of the month but available monthly data suggests that net exports were the main drag on growth, while investments and the construction sector were growth-supportive. Private consumption declined.

A mix of one-offs and more worrying structural factors

The disappointing performance of the German economy in the third quarter can be explained by several one-off factors but also some more worrying structural developments. Problems with the emission norms created severe production problems in the automotive industry, higher energy prices completely erased previous wage increases and also don’t underestimate the negative confidence effect from the World Cup. We don’t dare to predict the performance of the national football team but at least the automotive sector should rebound in the coming months and somewhat lower energy prices should revamp private consumption. However, the poor export performance, despite a weak euro exchange rate, suggests that trade tensions and weaknesses in emerging markets could continue to weigh on Germany's growth performance.

Wake-up call

Looking ahead, the late-cycle economy is likely to fluctuate between hopeful and worrying news and developments. Low interest rates, a weak euro and some fiscal stimulus, as well as the reversal of adverse one-off factors, are strong arguments in favour of a growth rebound in the coming quarters. At the same time, however, dropping capacity utilisation and increasing external risks put a lid on any upside potential.

In sum, the outlook for the German economy is still positive and swan songs will have a short shelf-life but the reputation of the invincible strong man (or woman) of Europe has received some scratches. After the latest political developments, today’s disappointing growth data is yet another wake-up call that political stability and strong growth are by no means a given.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”