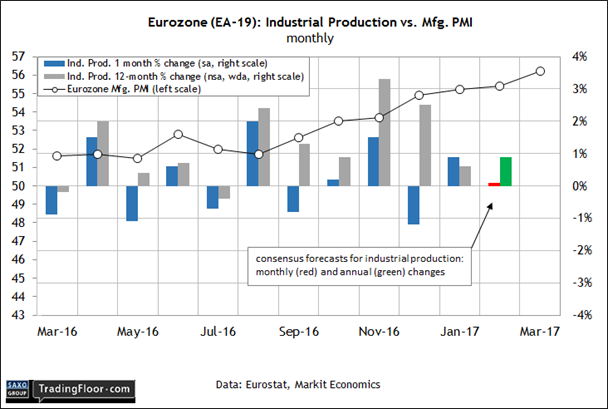

- Eurozone industrial activity is expected to increase for a second month

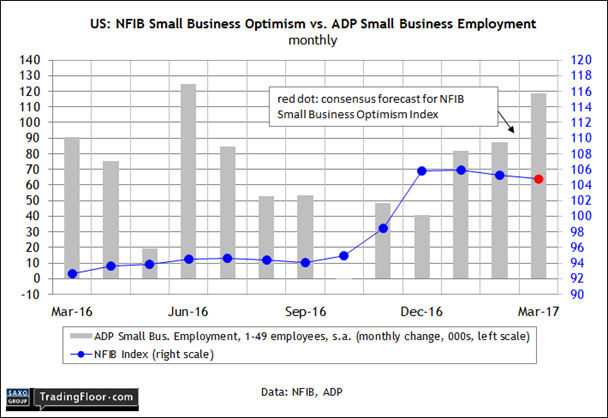

- US Small Business Optimism Index on track to hold on to post-election gains

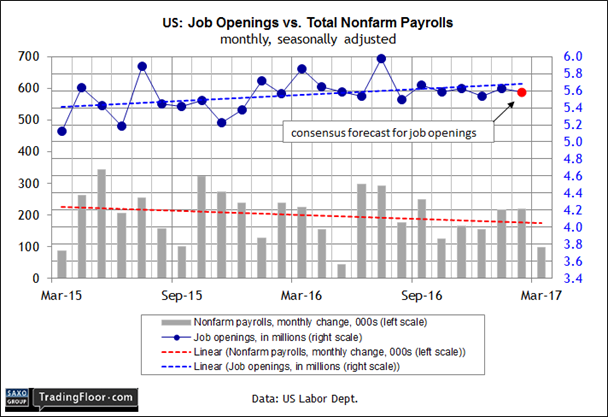

- US job openings are projected to post only a middling gain relative to recent history

Industrial activity in February is the main event for Eurozone economic reports today. Later, we’ll see the March update of the NFIB’s Small Business Optimism Index for the US, followed by the government’s estimate of new US job openings in February.

Eurozone: Industrial Production (0900 GMT) Today’s hard data on industrial activity in the euro area offers another opportunity for deciding if the recent improvement in economic growth for the currency region overall will be sustained in the months ahead.

Output increased in Germany and Italy in February in February, while production slumped in France and Spain. Photo: Shutterstock

Economists expect that industrial output will rise for a second month in February, albeit just barely at 0.1%, based on TradingEconomics.com’s consensus forecast. Note, however, that the year-over-year trend is projected to edge up to a 0.9% increase – modestly above the 0.6% pace for January.

February industrial data has already been published for the big-four economies, and the numbers paint a mixed profile. Output increased in Germany and Italy in February compared with the previous month, while production slumped in France and Spain. The year-over-year data looks more encouraging, with three countries posting gains; only France suffered a decline in February relative to the year-earlier level.

Overall, the data suggests (and economists predict) that we’ll see a modest rate of growth in Eurozone industrial activity for February. No one will confuse the projected gain with a robust rate of expansion. But the news looks set to provide another round of statistical support for arguing that the currency bloc’s modest recovery will roll on for the foreseeable future.

That’s already the message in the latest survey data for projecting the Eurozone’s first-quarter GDP growth. Markit’s Eurozone PMI implies that economic activity overall will pick up to a 0.6% quarterly increase in the first quarter – moderately firmer than the 0.4% pace in the previous quarter.

Based on what we know at the moment, today’s industrial report will probably provide more evidence that the macro trend is headed for a degree of improvement in the official Q1 GDP data that’s scheduled for release next month.

US: NFIB Small Business Optimism Index (1000 GMT) Jobs growth turned sluggish in March, according to the US Labor Department, but small companies added workers at a substantially faster rate last month, based on ADP figures.

The consultancy reported last week that US firms with 49 or fewer workers created 118,000 positions in March, the most in nine months. The increase represents a dramatic recovery from last October, when the labour force for these companies contracted slightly.

Perhaps then it’s no surprise to see that the mood in recent months has improved among owners of small companies. “It is clear from our data that optimism skyrocketed after the election because small-business owners anticipated a change in policy,” the president of the National Federation of Independent Business (NFIB) said last month.

Other measures of economic sentiment have rebounded too, including the University of Michigan’s Consumer Sentiment Index. The director of the survey noted, however, that expectations vary based on political affiliation. Democrats are generally pessimistic about the outlook for the economy while Republicans are upbeat. “We’ve never recorded this before,” Richard Curtin said last week. “The partisan divide has never had as large an impact on consumers’ economic expectations,” he explained.

Does the division taint the validity of the generally upbeat numbers? No one’s really sure at this point, although the rebound in employment in the small-business sector suggests that there’s more than wishful thinking unfolding in this corner of the economy.

Econoday.com’s consensus forecast sees the index ticking lower in today's update for March, to 104.8 from 105.3 in February, but the projection still reflects a hefty gain relative to the pre-election readings. If so, the news will provide more support for predicting that small companies will add new jobs at a faster pace this year vs. 2016.

US: Job Openings & Labor Turnover Survey (1400 GMT) Deciding if the sharp slowdown in jobs growth in March is a genuine warning or just noise is turning out to be a challenging task, as two follow-up reports published on Monday suggest.

On the bright side, the Conference Board’s (CB) Employment Trends Index (ETI), which aggregates eight labour-market indicators, ticked higher last month. The increase suggests that “solid job growth will continue through the spring”, CB’s chief Economist predicted. “The surprisingly weak job growth in March is mostly noise in an otherwise healthy and tight labor market.”

Maybe, although the US Federal Reserve’s multi-factor Labor Market Conditions Index (LMCI) fell last month. On the bright side, the broadly defined benchmark remained in positive territory: LMCI dipped to 0.4, the lowest reading so far this year.

Today’s update on jobs openings for February will dispense another perspective, albeit with a one-month lag relative to payrolls. The good news is that economists expect the number of newly created positions to hold mostly steady. TradingEconomics.com's consensus prediction sees the total dipping fractionally from a seasonally adjusted 5.626 million new jobs in January to 5.590m– a middling number relative to recent history.

If the forecast holds, the news will provide support for CB’s upbeat analysis on the outlook for jobs. But in the wake of the weak data for March payrolls generally, the potential for a deeper-than-expected slide can’t be ruled out in today’s release.

Disclosure: Originally published at Saxo Bank TradingFloor.com