Understanding the plan to create a $50 billion Ukraine bond from Russia’s blocked assets

The just-passed REPO Act empowers but does not force the US government to seize Russian sovereign assets to support Ukraine. Crucially, it acknowledges the need for robust engagement with G7 allies. As the GeoEconomics Center has covered extensively in the past, there is considerable opposition to irreversibly confiscating Russia’s blocked reserves among the main custodians of the assets in Europe and in Japan.

The European Union (EU) has made some progress on its conservative plan to tap into the interest income but its own estimates say this will provide about $3.5 billion a year. However, Ukraine’s needs are much greater. The first tranches of the Ukraine Facility Platform agreed by the EU—the $7.9 billion direct financial aid planned in the supplemental and aid from other supporters—all combine to provide enough for 2024. But Kyiv cannot afford to again face cash flow issues similar to what it endured earlier this year.

As Ukraine continues to fight for its survival now, bringing the value of the staggered interest income into the present would at least provide much-needed visibility for funding in 2025. In late March, reports surfaced that the United States was pushing the G7 to consider a sovereign loan of $50 billion to Ukraine which would be repaid using the interest income.

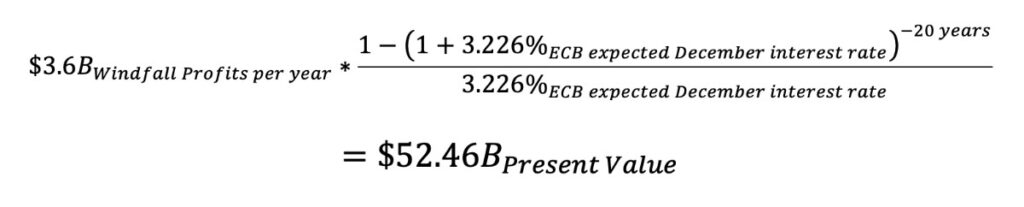

Where does this $50 billion figure come from? Given that we know many of the parameters the White House is working with—from interest rates to the regular income stream they create—our team dusted off our corporate finance textbooks and tried to retrace their steps.

Scenario 1 is the current EU workstream. If we use today’s interest rates and the amount Russia’s reserves are gaining in overnight lending, Ukraine could expect to receive around $3.6 billion in 2025 as part of “windfall profits.” Of course, as interest rates fall in the Eurozone, future earnings may shrink.

Scenario 2 is what the United States is pushing for ahead of the June G7 Leaders’ Summit in Italy. Daleep Singh, Deputy National Security Advisor, has asked: Why only give Ukraine this year’s profits when you could, in fact, pull forward future interest earnings? How much money would that mean for Ukraine in 2025? We think it would look something like this:

You can quibble with our annuity formula, but the bottom line is that $50 billion dollars is an incredible influx of cash that would guarantee payments to the entire military and civil service, help with recruiting efforts, ensure financial stability, and catalyze private investment. Plus, as far as Ukraine is concerned, it would be given as a grant, not a loan.

Like everything with these assets, the idea is controversial. It requires believing that the reserves will continue to be blocked for twenty years or given over to Ukraine. Otherwise, the G7 is on the hook for repayment. Remember, the block on the assets has to be unanimously renewed every six months by the 27 member states of the EU.

That’s all the more reason this approach may be the best option to get Ukraine a significant amount of money in 2025. It’s not seizing all of the $280 billion, which the Europeans and Japanese remain opposed to, but it’s almost fifteen times more than what’s on the table from the current EU proposal, which is still far from operational. Expect to hear more on this debate as the June G7 Summit in Apulia, Italy, draws closer.

Charles Lichfield is the deputy director and C. Boyden Gray senior fellow of the Atlantic Council’s GeoEconomics Center

Mrugank Bhusari is assistant director at the Atlantic Council’s GeoEconomics Center

Sophia Busch contributed to this piece

This post is adapted from the GeoEconomics Center’s weekly Guide to the Global Economy newsletter. If you are interested in getting the newsletter, email

SBusch@atlanticcouncil.org

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.

Further reading

Thu, Sep 21, 2023

The West won’t seize Russia’s reserves any time soon. Here’s what it can do with the funds instead.

New Atlanticist By Kimberly Donovan, Charles Lichfield

Frozen Russian assets could be invested profitably, with the goal of creating an annuity for Ukraine of at least two billion dollars a year.

Fri, Feb 23, 2024

Russia’s blocked assets: A ‘non-collateral collateral’ plan could be the way forward

New Atlanticist By Charles Lichfield

Instead of seizing Russia’s immobilized sovereign assets outright, G7 members seem instead to be aligning around “unlocking their value.”

Sun, Apr 28, 2024

US takes big step toward making Russia pay for Ukraine invasion

UkraineAlert By

While attention has focused on the military aspects of the new US aid package for Ukraine, the bill also includes an important step toward holding Russia financially accountable for the invasion, writes Kira Rudik.

Image: The Central Bank of Russia, Moscow, Russia, May 22, 2017/Shutterstock