KUWAIT: The global economy continues to hum along, though political headwinds and weather conditions have complicated matters in recent weeks. While the major economies have either maintained robust growth or seen some improvement, the North Korea crisis and severe weather conditions in the US have weighed on markets. Analysts also began to question whether promised US reforms will materialize following months of legislative failures. Thus, despite the improving economic figures, yields have declined generally and stock markets have lost some of their gains. The US dollar also continued its retreat from its 2016 highs, in part as the eurozone outlook has improved.

KUWAIT: The global economy continues to hum along, though political headwinds and weather conditions have complicated matters in recent weeks. While the major economies have either maintained robust growth or seen some improvement, the North Korea crisis and severe weather conditions in the US have weighed on markets. Analysts also began to question whether promised US reforms will materialize following months of legislative failures. Thus, despite the improving economic figures, yields have declined generally and stock markets have lost some of their gains. The US dollar also continued its retreat from its 2016 highs, in part as the eurozone outlook has improved.

In the US, politics has dominated. Markets, which had been anticipating a significant stimulus from promised tax reform, have begun to question whether this can still be agreed upon this year. Also, a debt ceiling and budget fight was expected in September, though this has now been pushed to later in 2017, after president Trump struck a deal with congressional Democrats. Markets were initially worried that failure to reach an agreement on a new budget and the debt ceiling could force a government shutdown, ultimately delaying the Fed's next rate hike. The risk of this has now receded following the deal to postpone the debt-ceiling question.

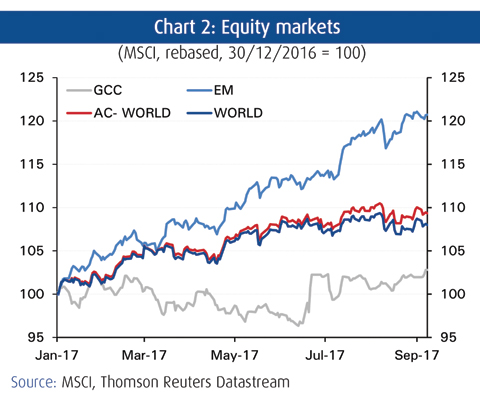

Meanwhile, US growth has remained robust, with most indicators either steady or improving. The latest ISM indexes were no exception, with the manufacturing index hitting its highest level since 2011. The employment report, while slightly below expectations, continues to confirm a healthy labor market. Much of the improved momentum has been driven by optimism that Mr. Trump's reform agenda will be implemented in a reasonable timeframe. That is now beginning to look less likely after several legislative initiatives failed to make it through Congress. This could weigh on sentiment in the months ahead, especially given relatively high equity valuations.

Nonetheless, markets are less convinced today than they were just weeks ago that the Fed will see another hike in its policy rate target this year. Indeed, the likelihood of a Fed rate hike in December has now declined to 32%; we do not expect one. As for next year, the market consensus is for 2-3 hikes; we are more sanguine, expecting just one to two 25 basis point hikes. Meanwhile, the Fed is also expected to announce the starting date of an expected balance sheet reduction in the coming weeks. The announcement itself is unlikely to rattle markets.

In Europe, conditions have continued to shift toward a more positive stance. The economic figures have broadly been surprising to the upside, with GDP growth in the eurozone revised upward in recent months. More recently, that trend was bolstered by further strength in the PMI and inflation. Inflation has also been stronger than prior expectations; headline inflation in August rose to 1.5 percent y/y. Though still well below the 2 percent target, inflation forecasts are now more upbeat.

Retreating political risks have been part of the improving story in Europe. The risk of populists coming to power or gaining traction is much diminished after elections in the Netherlands and France saw those forces defeated. In France, the election of reform-minded Emmanuel Macron even bolstered hopes of a more market-friendly era. Elections in Germany later this month, which never represented a significant risk to begin with, are now expected to be easily won by Mrs. Merkel, maintaining the status quo. Nonetheless, some political risks remain on the horizon including an Italian election sometime in the next 12 months and the progress of Brexit talks, which risk using up valuable political capital and risk souring EU-UK relations.

Robust EU economies and shaky US politics combined to push the euro higher this year. The currency rose to 1.20 versus the dollar in August and is now up 14 percent against the US currency this year. Some of this move has also reflected the changing interest rate outlook in the US, especially on the likelihood of a December Fed hike. However, the euro has been strengthening consistently since late 2016, at a time when optimism of US reforms was still strong and long before markets began to entertain serious doubts on these.

ECB dilemma

The stronger euro has certainly complicated life for the European Central Bank. The ECB's Mario Draghi, who has been focused on ensuring a smooth transition to a "less-loose" monetary policy, is now having to talk down the euro, lest it derail the economic recovery. However, when it comes to the ECB's quantitative easing (QE), markets know that it is unlikely to continue much longer past the middle of next year due to the structural limitations of the program (i.e. there are few German bonds left to buy). Nonetheless, observers are keen to hear more details about how the ECB plans to end QE.

Japan has also surprised on the upside in recent months, though this trend will be harder to sustain. Generally, quantitative easing there has been far less effective and authorities still do not have their sight on the end of QE. Moreover, though the IMF did nudge their growth outlook for 2017 to 1.3 percent, growth is expected to return to 0.6 percent in 2018. Meanwhile, Japanese inflation remains mired below 1 percent, unlike inflation in the US and the eurozone where it has perhaps started to approach 2 percent. Emerging markets (EM) growth has also been improving despite a moderating pace in China. EM growth is seen rising to 4.6-4.8 percent in 2017 and 2018 by the IMF. The trend there has been relatively steady with China continuing to manage a smooth slowdown while avoiding major bumps along the way. Beyond China, growth has been recovering as recessions in commodity exporting (Brazil, Russia) countries recede.

An improving economic outlook combined with the risks from the North Korea crisis and bad weather have helped push oil prices upward in recent months. Brent rose past $54 per barrel in early September; this is $10 higher than recent lows in late June 2017. The price has also been supported by the OPEC decision to extend production cuts for an additional nine months after these were due to expire in mid-2017. The price recovery has remained relatively limited, largely due to resilient shale oil production in the US and high crude oil stocks.

NBK INTERNATIONAL MARKET REPORT